Why Startups Should Use KARTA io from Day One

April 10, 2025 | by brownbrown52352@gmail.com

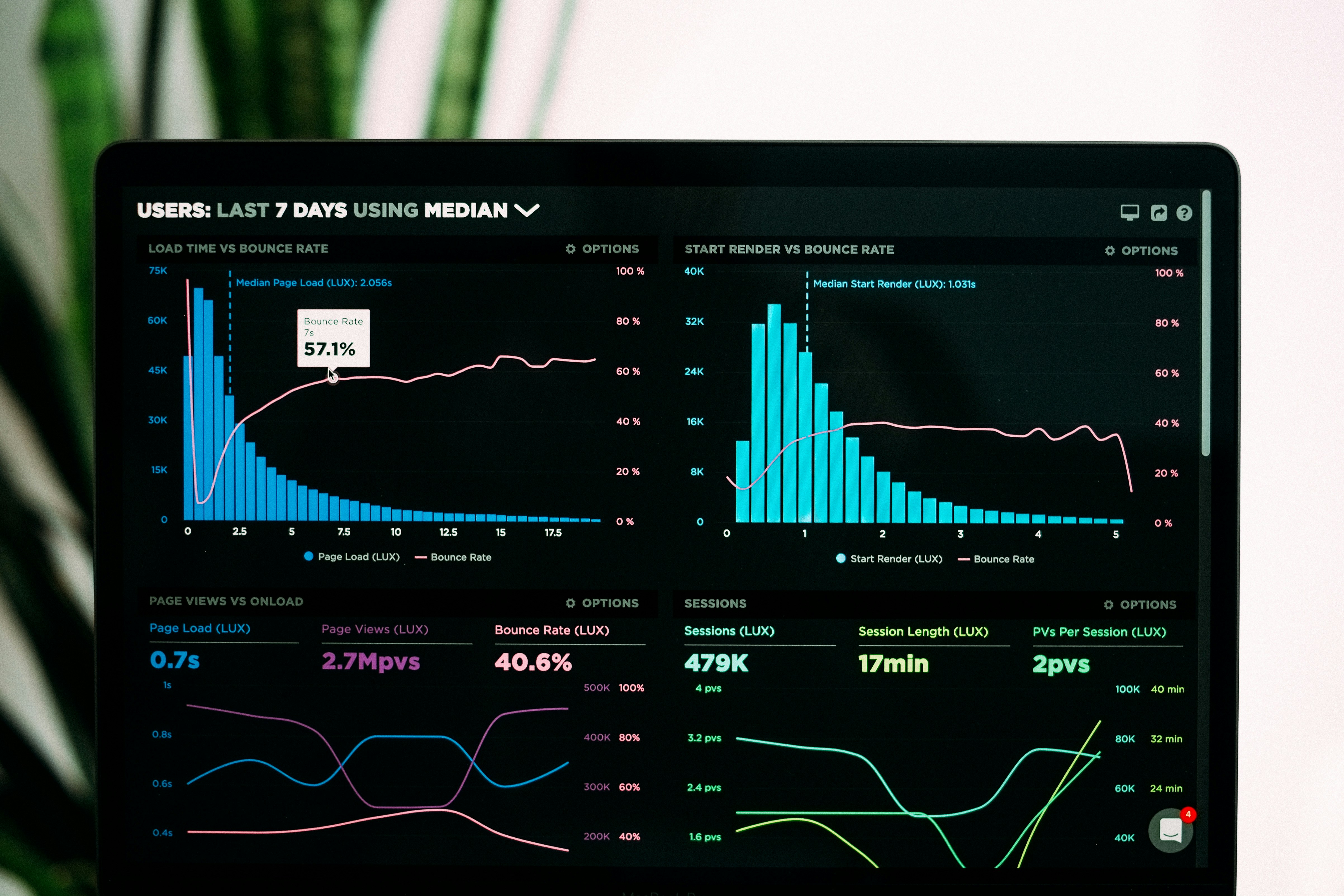

Photo by Luke Chesser on Unsplash

Photo by Luke Chesser on Unsplash When you’re building a startup, every dollar counts. Whether you’re bootstrapping or just raised your first round of funding, one thing is certain: poor expense management can kill momentum fast.

That’s why many founders and early-stage teams turn to KARTA io — a modern spend management platform that gives you control over business spending from day one. With virtual cards, real-time insights, and automation, KARTA io keeps your team focused on growth, not financial clean-up.

Here’s why KARTA io is a must-have for startups.

🚀 1. Control Burn Rate Without Micromanaging

Startups live and die by cash flow. KARTA io helps you:

- Set strict spending limits on every card

- Get instant alerts when a threshold is hit

- Monitor spend in real time across teams and tools

No more surprises at the end of the month. You’ll always know where money is going and why.

💳 2. Issue Instant Virtual Cards for Tools, Ads, and Teams

Instead of using one shared credit card (risky!), KARTA io lets you:

- Issue unlimited virtual cards for:

- Google Ads

- SaaS subscriptions

- Freelancers or agencies

- Individual employees

- Set expiration dates and auto-locks

- Create single-use cards to test new services

✅ Result: Better control, reduced fraud, easier tracking

🧠 3. Smart Budgeting Without a Finance Department

Most startups don’t have a full finance team yet — and KARTA io makes that okay. With built-in tools, you can:

- Set monthly or project-based budgets

- Restrict cards by merchant type or location

- Automatically categorize and tag spend

💡 Even non-finance founders can use KARTA io like pros.

📊 4. Track ROI Across Marketing Channels

Running multiple ad campaigns? KARTA io lets you:

- Assign a separate card per platform or campaign

- Limit spend by channel (e.g., $2,000/month for Meta)

- Track real-time ROI and performance metrics

No more messy invoices or vague spending reports. Just clear, actionable data.

📉 5. Avoid Early-Stage Waste

Early-stage startups often lose money on:

- Forgotten subscriptions

- Duplicate SaaS tools

- Untracked team spend

- Unused services still billing monthly

KARTA io solves this with:

- Smart alerts for duplicate or unusual spend

- Auto-expiring cards for temporary tools or trials

- Full transparency across every card and expense

📌 You’ll stop bleeding cash on things that don’t drive growth.

🔄 6. Scale Without Financial Chaos

As your startup grows, so do the risks:

- More people spending

- More tools and campaigns

- More complexity in budgeting

KARTA io scales with you:

- Add new team members instantly

- Create cards for new hires and partners

- Connect to QuickBooks, Xero, or Google Sheets for clean reporting

You grow — KARTA io keeps everything organized.

🛡️ 7. Investor-Friendly Financial Hygiene

Want to impress investors? Show them:

- Clean spend tracking

- No bloated or hidden costs

- Automated financial workflows

- Smart, proactive controls

Founders who use KARTA io demonstrate discipline and financial clarity, which can build trust with VCs and partners.

Final Thoughts

Startups don’t just need to move fast — they need to move smart. With KARTA io, you can:

✔️ Launch with confidence

✔️ Manage cash flow effortlessly

✔️ Automate spend control

✔️ Scale without chaos

Don’t wait until you’ve made expensive mistakes. Start managing your business spend from day one — with KARTA io.

👉 Ready to take control of your startup’s money? Try KARTA io today — it’s free to get started.

RELATED POSTS

View all