KARTA io: The Smarter Way to Manage Business Expenses with Virtual Cards

April 10, 2025 | by brownbrown52352@gmail.com

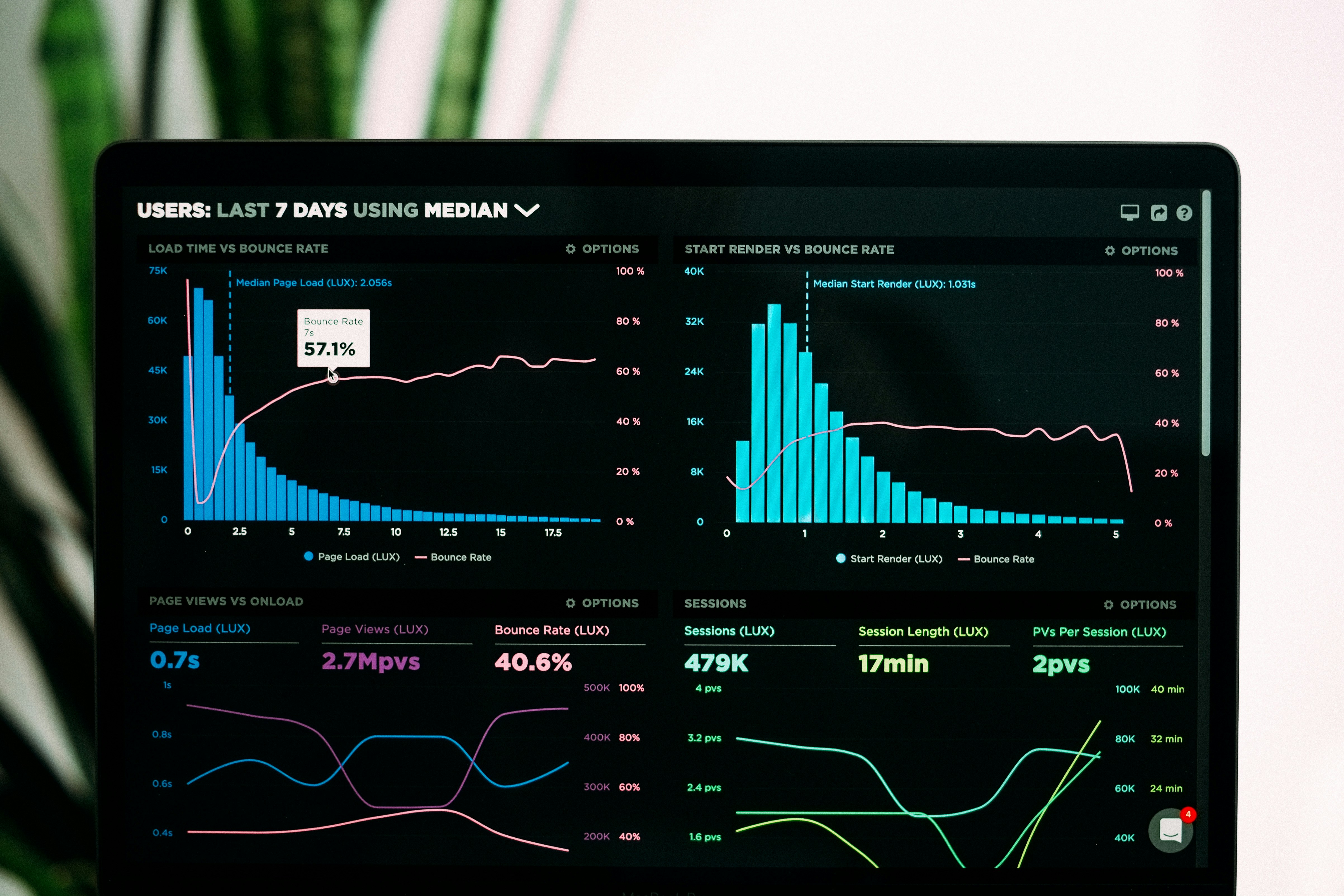

Photo by Luke Chesser on Unsplash

Photo by Luke Chesser on Unsplash Modern businesses need more than just spreadsheets and plastic cards to manage their finances. With subscriptions, ad campaigns, remote teams, and SaaS tools multiplying, traditional spend control just doesn’t cut it. That’s where KARTA io comes in — a powerful platform that helps companies take full control of their expenses using virtual cards and automation.

Whether you’re a startup founder or a CFO of a growing team, KARTA io offers the flexibility and transparency you need to stay on budget, cut waste, and scale smartly.

What Is KARTA io?

KARTA io is a digital spend management platform designed for businesses of all sizes. It offers instant virtual credit cards, centralized control over spending, and seamless integration with accounting software. Unlike traditional cards or banking tools, KARTA io is purpose-built for fast-moving teams, agencies, startups, and modern finance teams.

Key Features of KARTA io

💳 Unlimited Virtual Cards

Issue instant virtual cards for every employee, campaign, tool, or transaction. Create and cancel cards in seconds.

🧠 Smart Spending Rules

Set card-specific limits, define merchant types, and approve expenses before they happen.

📊 Real-Time Expense Tracking

Monitor every transaction as it happens. Get full visibility into where your money goes — and why.

🔄 Accounting Integrations

Connect KARTA io to QuickBooks, Xero, and more. Automate reconciliation and simplify month-end reporting.

📂 Receipt Collection & Categorization

Employees can upload receipts directly. The system automatically matches them with the correct transaction.

How Companies Use KARTA io

KARTA io is flexible enough to support a wide range of business needs:

- Marketing Teams: Track ad spend across Facebook, Google, TikTok with dedicated cards

- Finance Departments: Gain real-time oversight and control with centralized dashboards

- Operations: Pay freelancers or vendors with single-use cards to reduce risk

- Startups: Scale fast with built-in budget controls and audit trails

Why Choose KARTA io Over Traditional Business Cards?

| Feature | Traditional Cards | KARTA io |

|---|---|---|

| Virtual Cards | ❌ Limited | ✅ Unlimited, Instant |

| Spend Control | ❌ Manual tracking | ✅ Smart limits & rules |

| Reconciliation | ❌ Spreadsheet chaos | ✅ Automated & integrated |

| Fraud Prevention | ❌ Shared cards = risky | ✅ One-use & team-based cards |

| Visibility | ❌ After-the-fact | ✅ Real-time reporting |

✅ With KARTA io, you control spending before it happens, not after.

Security and Compliance

- PCI DSS compliant infrastructure

- Built-in fraud protection

- Role-based access and approval workflows

- GDPR-compliant data management

KARTA io is built with enterprise-grade security, so you can scale with confidence.

Getting Started with KARTA io

- Sign up through the official KARTA io website

- Complete quick onboarding

- Issue your first virtual card in minutes

- Invite team members and start managing expenses smartly

You don’t need to change your bank — KARTA io works alongside your existing financial stack.

Final Thoughts

If you’re still juggling Excel files, shared credit cards, and end-of-month surprises, KARTA io is your solution. It’s time to modernize your company’s expense management with virtual cards, automation, and real-time control.

No more lost receipts. No more overspending. No more chaos.

RELATED POSTS

View all